As a trader, it’s important to have a variety of trading strategies at your disposal. One such strategy is the calendar spread, which involves buying and selling options with different expiration dates. This article will delve into the details of the calendar spread and discuss its advantages, disadvantages, and how to use it in trading.

What is a calendar spread?

A calendar spread is a trading strategy where the trader simultaneously buys and sells two options of the same underlying asset with different expiration dates. One option is typically a near-term option, while the other is a longer-term option. This strategy is also known as a horizontal spread or time spread.

How does a calendar spread work?

The idea behind a calendar spread is to take advantage of the difference in time decay between the two options. The near-term option will decay faster than the longer-term option. If the price of the underlying asset remains stable, the near-term option will expire worthless while the longer-term option will retain some value.

Advantages of calendar spreads

There are several advantages to using a calendar spread in trading, including:

1. Reduced risk

A calendar spread reduces risk compared to buying or selling an option outright. The trader is protected against a sudden price movement in the underlying asset.

2. Potential for profit

If the price of the underlying asset remains stable, the trader can profit from the difference in time decay between the two options.

3. Versatility

A calendar spread can be used in a variety of market conditions, including neutral, bullish, and bearish.

4. Cost-effective

A calendar spread is a cost-effective way to enter the options market compared to buying or selling an option outright.

Disadvantages of calendar spreads

There are also some disadvantages to using a calendar spread in trading, including:

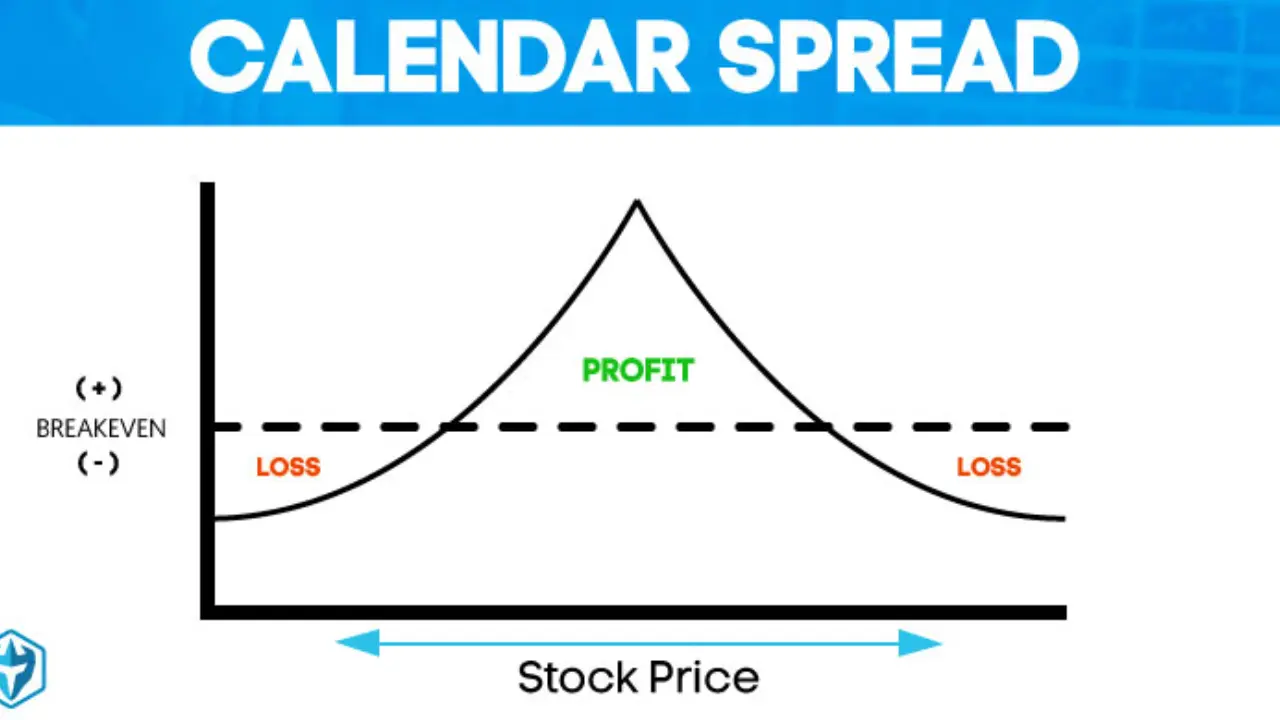

1. Limited profit potential

The profit potential of a calendar spread is limited compared to other options trading strategies.

2. Limited loss protection

While a calendar spread reduces risk compared to buying or selling an option outright, it still has limited loss protection.

3. Complexity

A calendar spread can be more complex than other options trading strategies, which may be a disadvantage for novice traders.

Using a calendar spread in trading

Now that we understand what a calendar spread is, let’s look at how to use it in trading. Here are the steps to take:

1. Identify a market-neutral strategy

A calendar spread works best in a market-neutral strategy. Look for stocks or assets that are expected to remain stable in the short term.

2. Select the options

Choose two options with different expiration dates. The near-term option should have a lower premium than the longer-term option.

3. Buy the longer-term option

Buy the longer-term option to open the position.

4. Sell the near-term option

Sell the near-term option to complete the calendar spread.

5. Monitor the trade

Monitor the trade closely and consider adjusting the position if the price of the underlying asset moves significantly.

Finally

In conclusion, a calendar spread is a cost-effective and versatile options trading strategy that can be used in a variety of market conditions. It offers reduced risk and potential for profit, although its profit potential is limited. As with any trading strategy, it’s important to understand the advantages and disadvantages before implementing it.